Do you want to know if your plan is one of Cedar Recovery’s accepted insurance providers for opioid addiction treatment? The best way to know what your plan covers is to work with your insurance provider to understand your specific coverage. You’ll want to not only understand what your provider covers in general, but what your individual insurance plan covers, as coverage may vary depending which plan you have.

What services are covered by my insurance plan?

Generally speaking, most major insurance carriers and plans include some coverage for addiction treatment. However, not all health insurance policies are the same. Your insurance policy might cover the entire cost of treatment, or just a percent of the total cost. The amount of treatment coverage you’ll receive depends largely on the type of insurance you have. Each person’s insurance plan is different. You may have a copay, a deductible, or be required to meet certain criteria before starting treatment. These are things you will want to know ahead of time.

The best way to know what your plan covers is to work with your insurance provider to understand your specific coverage. You’ll want to not only understand what your provider covers in general, but what your individual insurance plan covers, as coverage may vary depending on which plan you have.

Tennessee

Below are insurance providers in-network with Cedar Recovery.

Medicaid:

- Blue Care

- United

- Wellpoint (formerly Amerigroup)

Commercial:

- Aetna (including Aetna network carriers)

- Ambetter

- BCBS

- Cigna

- Humana

- Multiplan/PHCS

- Tricare

- United

Medicare/Medicare Advantage:

- Aetna

- BCBS

- Cigna Healthsprings

- Humana Gold Choice

- Medicare Part B

- United

- Wellcare

- Wellpoint (formerly Amerigroup)

Virginia

Below are insurance providers in-network with Cedar Recovery.

Medicaid:

- Anthem Healthkeepers

- Molina

- Sentara

- United

- Aetna Better Health

Commercial:

- Aetna

- Anthem Healthkeepers

- BCBS

- Cigna

- Humana

- Multiplan/PHCS

- Tricare

- United

Medicare/Medicare Advantage:

- Medicare Part B

- Aetna

- United

- Humana

- Anthem Health Keepers

- Sentara

Self-pay options

Our self-pay rate is $250/week. This will include any medical and therapy visits during that week. Any therapy visits that occur outside of the week of a medical visit will be $100. This payment will be required prior to each visit, or your visit will be rescheduled.

If you are a new patient, we have a discount of $500/first 4 weeks (28 days). This discount is available only when paid prior to the first visit.

If your commercial insurance does not pay for our services, due to non-coverage or the payment is not received within 180 days, the claim will be re-billed as self-pay.

Minimum payment policies

Financial responsibility is a piece of recovery. Due to legal contracts with the insurance companies, Cedar Recovery must collect payments based on what the insurance company requires.

Cedar Recovery calculates the estimated rates based on your insurance benefits and your insurance’s contracted rates. This calculation includes your medical and therapy services scheduled for that day’s visit.

For those who have copays and coinsurance, Cedar Recovery will require the estimated rate prior to your visit.

For those who still have deductibles, Cedar Recovery will require a portion of this payment, depending on the amount remaining. We always request the full estimated rate for your services, but we only require $200 if your estimated rate is more. For those who only have copays or coinsurance, Cedar Recovery will require the estimated rate prior to your visit. If you are unable to make your payment you will be rescheduled.

Warning visits: because we know that there may be a time when you may be unable to make your minimum payment. We do allow a visit, called the warning visit, which your minimum payment will not be required prior to your visit. This does not mean you will not have to pay for the visit, but you can pay for it at another time.

Self-pay patients do not have a minimum payment, they are required to pay the entire rate prior to being seen. They do not have the ability to have a warning visit.

Insurance 101: Terminology

Insurance can be complicated and confusing, almost like a second language. Understanding insurance terminology will aid you in better understanding your insurance benefits and balances. This will help you understand your patient responsibility not just for Cedar Recovery, but other health care services as well.

The first term to start wrapping your heads around is “network status.”

- In Network: this means the medical practice has a contract with the payer. This contract usually outlines the rates which they will pay for the services provided.

- Out of Network: this means the medical practice does not have a contract with the payer. This means that there is no guarantee of coverage, and the rate is much more difficult to predict.

Cedar Recovery does not accept primary insurances that we do not have contracts with.

Types of Insurance Payers

- Medicaid: a government-sponsored insurance program for individuals and families whose income is insufficient to cover health related services. In Tennessee, Medicaid is also known as Tenncare. These patients should not have to pay anything toward their visits while their coverage is active.

- Medicare: a federal health insurance program for people aged 65 years or older and people with certain disabilities. Now, some insurance companies have created their own Medicare programs called “Medicare Advantage”. Most of our patients over the age of 65 have some version of Medicare.

- Supplemental Insurance: these are plans “gap insurances” that help pay for services that a patient’s Medicare or Medicare Advantage plan doesn’t cover. These plans usually cover copays and coinsurance costs. They do not always cover deductibles.

- Commercial: health insurance provided and administered by non-governmental entities. For people who have jobs, you most likely have access to health insurance through your employer. You may also have health insurance through your spouse or your parent’s employers. Commercial policies are also available through the marketplace.

While many people have only one insurance policy, it is possible to have two. This is most common when a patient has Medicare and Medicaid. When you have more than one insurance policy, it is important for Cedar Recovery and you to know which one is primary.

- Primary: your main insurance policy. This is usually a commercial or Medicare plan. If you only have one insurance policy, that is your primary.

- Secondary: this insurance policy helps cover what your primary insurance does not. For those with Medicare, you may have a supplemental insurance policy or a Medicaid policy.

- Tertiary: there are some circumstances where you may have three different insurance policies. It is not common but can happen. This tertiary insurance policy would help cover what your primary and secondary insurances did not.

It is important to note that just because you have multiple insurances, does not mean you wouldn’t owe anything for your care. It depends on the insurance policies.

Depending on what type of insurance plan, you may or may not have patient responsibility. If you do, it is because your insurance plan may assign certain costs to you. The following terms are some of the costs you may incur:

- Premiums: the amount of money they pay for their insurance policy. This is usually paid for out of the person’s paycheck monthly or bi-weekly. The cost is not available for Cedar Recovery to see.

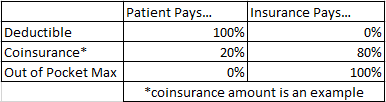

- Deductible: The amount the patient pays for health care services before insurance begins to -pay.

- Copayments: The fixed amount the patient must pay prior to receiving the service

- Coinsurance: Their share of the cost of a health care service, usually a percentage of the services rendered. This comes into effect after deductible is met.

- Out of Pocket Maximum: The most insurance could charge a person for covered services in a plan year. After deductibles, copayments, and coinsurance have been met, insurance pays 100% of the costs of covered benefits.

Insurance Frequently Asked Questions

Who do I contact about my insurance or my Cedar Recovery bills?

The front office may have some knowledge about insurance, but your best resource is the insurance verification team. The front office should have business cards with this information. If you are a current patient, you can reach them one of two ways:

- Phone: (615) 208-9549

- Via Email: insurance@cedarrecovery.com

The Insurance Verification Team can help answer the following questions:

- Insurance Verification

- Understanding Insurance Benefits

- Explaining your estimated rates for Cedar Recovery services

- Balances

Do I have to use my insurance?

Short answer: it depends on what type of insurance you have.

If you have Medicaid or Medicare coverage, primary or secondary, you must use your insurance.

If you only have Commercial insurance, it is your choice. You can use it or you can decide to be seen as a self-pay patient.

Disclaimer: if you decide to change your mind and use or stop using your commercial insurance it will update that day. We will not back date these requests.

It is encouraged that you use your commercial insurance if you have it. Remember that your deductible and out of pocket services apply to more than our services. Your deductible could apply to your primary care visits, emergency room visits, hospital stays, etc. If you pay as a self-pay patient, that cost is not going toward your deductible. Imagine spending $1,000 as a self-pay patient and having an ER visit that uses your deductible. If you had been using your insurance for both places, your overall healthcare costs could have been lower.

Where can I apply for Medicaid, Medicare, or Commercial Insurance?

If you believe you meet the requirements for Medicaid, you can find an application to the Tenncare website, if you are unable to complete the application online, you can contact Tenncare at 855-259-0701.

If you need assistance with Medicare—application, picking a plan, questions on medications, etc., you can find that information by clicking here.

If you do not qualify for Medicare or Medicaid and do not have health insurance through an employer, you can look into Marketplace plans. These policies can be found by clicking here.

To make sure I can use my insurance, how do I give you that information?

It is your responsibility to inform Cedar Recovery of your insurance policies and if there are any changes. Please bring your insurance cards to your first visit to be scanned in or take a picture of your cards. Cedar Recovery will need the front and back to get your policy information and the phone number to contact your insurance company in case we have questions.

If you need to email a picture of your card, you can send that to the insurance verification team (contact the office for this email).

I was asked to do Coordination of Benefits. What is that?

Coordination of benefits is when your insurance needs more information from you. This can happen for several different reasons:

- You had a primary insurance policy that is no longer active, and your secondary insurance has become your primary. Insurance companies don’t always talk to each other. If your secondary insurance becomes your primary, you may need to go online to your customer portal or call your insurance company to make sure they know that the previously secondary insurance is now primary.

- If you have been incarcerated. Patients who are in jail may lose their insurance coverage. But once you are out of jail, you need to make sure your insurance knows.

- If you have Medicaid, you need to contact Tenncare and let them know you are out of jail. The phone number for Tenncare is: 855-259-0701

- If you have Medicare, you will need to contact the Social Security Administration which will report to CMS. The phone number is 800-772-1213. If you need more information on this, you can find it on the CMS website.

- If you are up for Medicaid Renewal. Now that the public health emergency is over, Medicaid has re-instated their annual renewal process. If you have Medicaid, you will get information about your Tenncare renewal by mail. Because of this, it is important to update your address and contact information with Tenncare as soon as possible, and any time that changes. Cedar Recovery may have access to your renewal date and may remind you to complete the renewal packet to prevent unnecessary losses in coverage, but it is your responsibility to complete the renewal packet and contact Tenncare with any issues or updates. Please note: if you have questions regarding your renewal process, please contact Tenncare at 855-259-0701.

When Cedar Recovery brings this to your attention, do not put this off. Because this issue can affect the payments Cedar Recovery gets for your care, we take this very seriously. If you do not complete your coordination of benefits, it may result in disruption of your care. Cedar Recovery can help provide phone numbers and instructions as needed, just contact the insurance verification team if you have questions.